Growing Demand Revives Retail

A seasonal revival in consumer demand stimulated an increase inretail trade in Q2 2014. Food retail showed the best results, but intensified moods to save household earnings, a slowdown in income growth, high inflation, and difficulties in obtaining consumer credit might soon change the situation, according to experts from the Centre for Business Tendency Studies at HSE Institute for Statistical Studies and Economics of Knowledge in their latest monitoring of the retail business climate.

The business climate in the retail sector improved in Q2 2014. Entrepreneurial activity was on the rise in the industry, while the tension caused by volatility in Russia’s general economic and political climate eased up. This gave retailers the opportunity to close out the first half of the year with decent growth.

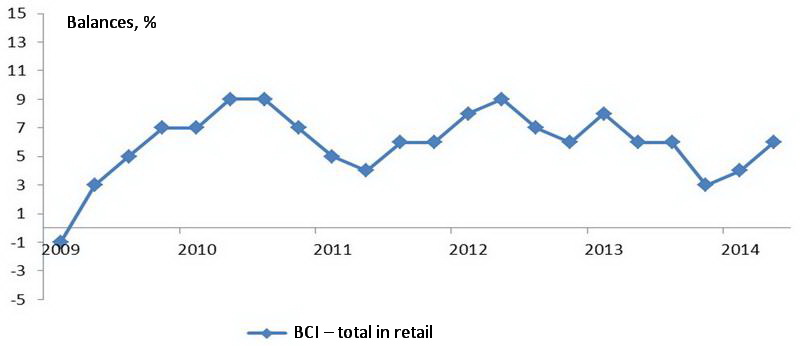

The survey’s key indicator — the Business Confidence Index (BCI) — climbed by 2% to +6% in Q2, which made up for the low figures in earlier quarters and brought the BCI back into the middle range of historical results from the last two years. Such were the primary results of an analysis of the financial activity of 4,000 companies in Q2 2014, conducted by the Centre for Business Tendency Studies at HSE Institute for Statistical Studies and Economics of Knowledge on the basis of Rosstat data.

Rising demand, reported by nearly a quarter of respondents, was responsible for the improved business climate in retail. Meanwhile, according to the institute’s experts, 20% of respondents noted higher demand in the previous period. There was a particularly pronounced revival of demand in food retail. “The chief source of the recovery process and of a certain resilience on the part of trade organisations in the period being analysed was the traditional spring and summer season, with the food driver alone setting the active phase of the progressive advance in motion. Meanwhile, the development dynamic in the non-food segment of the market indicates continuing stagnation”, the researchers stressed.

Despite the more favourable backdrop that formed on the outcomes, 47% of respondents said that “insufficient purchasing power” interfered with their growth. Furthermore, according to the monitoring, important trade indicators such as sales volumes and trade turnover did not overcome the boundary of the negative zone. In the end, few retailers were able to boast a significant increase in profit. However, whereas 35% of entrepreneurs recorded decreased profits in the first months of 2014, that number was down to 30% in the present quarter.

The authors of the monitoring warned that intensified moods to save household earnings, slowed growth in real disposable incomes, high inflation, and difficulties in obtaining consumer credit could “pinch” retail trade into stagnation.

The “prevailing passive expectations of the respondents regarding short-term changes to the economic situation at their companies” also constrain optimism.

Diagram 1. BCI Dynamic at Retail Organisations

Comments by Director of the Centre for Business Tendency Studies at HSE Institute for Statistical Studies and Economics of Knowledge Georgy Ostapkovich:

The current model for the sector’s development is definitely keeping not only experts, but also all of the interconnected participants in market relations, in suspense. At this stage, which is a kind of intermediate test of profitability and of prevailing sectoral possibilities, I can state the main thing: Russian retail, despite definite risks and the featureless development dynamic, favourably differs from the rest of the representatives of the real sector.

However, it should still be noted that the sector’s fate once again was in ‘consumer hands,’ and the awareness of this fact may not have added optimism to entrepreneurs for the short-term. By most measures, the respondents did not give encouraging opinions. In all likelihood, this circumstance should be connected with the obvious rise in moods to save household earnings, slowed growth in real disposable income, and quite high inflation, which causes difficulties in obtaining consumer credit. It should be noted that this last fact is particularly important because, on the backdrop of overlending to consumers in 2013, narrowed credit opportunities are capable of blocking sales to an added decree. Obviously, non-food retail, which is experiencing a clear shortage of buyer’s demand, will again fall under this measure to the greatest degree.

And if, judging by the signs of the monetary policy being pursued, the inflationary rally is close to completion, it will be impossible to manually adjust consumers’ motivation to spend their savings on non-essential goods in the near future. Time is needed to adapt the household consumer basket, which, unfortunately, is now playing against entrepreneurs.

As a whole, in the second half of 2014, the risk that existing economic problems will continue in the future is still present in the retail sector.

Author: Maria Denisova

Source: OPEC.ru