Innovation Activities in KIBS Firms: International Comparison

The HSE ISSEK experts compared data about the application of technological, marketing, and organisational innovations by the Russian knowledge-intensive business services sector (KIBS) companies with relevant figures for European countries such as the UK, Germany, Denmark, Malta, the Netherlands, and Switzerland. The results are presented in the latest newsletter in the "Science, Technology, and Innovation" series.

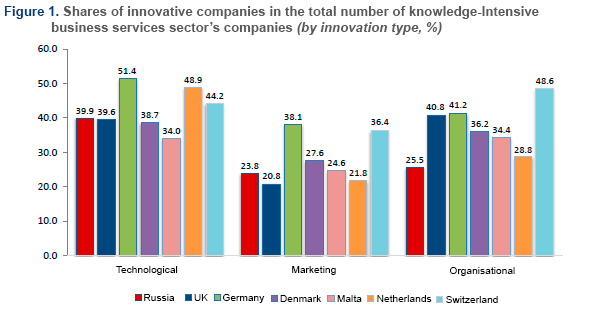

There’s a quite high demand for professional and specialised knowledge in the service sector1. This allows to include relevant industries into the knowledge-intensive business services sector2,3. In turn, producer companies active in this sector are seen as innovators4, while the sector as such, with its high innovation potential, creates highly productive jobs and value added services5. Figure 1 shows shares of innovative companies (by innovation type) in the total number of knowledge-Intensive business services sector’s companies in various European countries6 and in Russia7.

The share of companies applying technological innovations in the total number of knowledge-intensive business services sector’s companies varied from 34% in Malta to 51.4% in Germany. According to the survey, in Russia the share of such companies was 39.9% — comparable with relevant figures for Denmark (38.7%) and the UK (39.6%).

The share of Russian knowledge-intensive business services companies applying marketing innovations was about 24%, which is slightly higher than in the Netherlands and the UK (21.8 and 20.8%, respectively). However, it’s much lower than in Switzerland (36.4%) or Germany (38.1%).

Finally, in terms of organisational innovations the Russian knowledge-intensive business services sector lags far behind European countries: only 25.5% of Russian companies applied such innovations, while in the UK and Germany relevant figures were in excess of 40%. The leader among the countries under consideration was Switzerland, where almost a half of the sector’s companies applied organisational innovations.

A study8 shows that factors hindering knowledge-intensive business services companies’ innovation activities may be related to their financial situation (availability and costs of loans), resources (lack of skilled personnel and/or required technologies), or market situation (low competition). Table 1 presents the barriers hindering the sector’s development mentioned by Russian producers of knowledge-Intensive business services who did not apply innovations.

Table 1. Barriers hindering knowledge-intensive business services sector’s development identified by non-innovative companies (%)

|

|

2015 | ||

|

Insufficient demand |

27.7 | ||

|

Insufficient clients’ awareness |

17.5 | ||

|

Insufficient clients’ competences |

15.3 | ||

|

Lack of skilled personnel |

15.3 | ||

|

Lack of adequate infrastructure, including technologies and equipment required for use of relevant services |

13.1 | ||

|

Discouraging regional policy, including lack of support by regional authorities |

10.2 | ||

|

Clients’ unwillingness to participate in co-production |

7.3 | ||

|

Insufficient supply |

5.8 |

Major barriers most frequently mentioned by non-innovative knowledge-intensive business services companies included the following: insufficient demand (27.7%), insufficient clients’ awareness (17.5%), and insufficient clients’ competences (15.3%). This is yet another evidence of the important role clients play in the sector’s development. Another set of problems is related to lack of human resources required for innovation activities (15.3%), or lack of adequate infrastructure (13.1%). Some companies experienced the lack of support by regional authorities or discouraging regional policies (10.2%). Finally, the respondents mentioned such barriers as clients’ unwillingness to participate in co-production of services (7.3%), and insufficient supply (5.8%).

To sum up, the share of companies applying technological and marketing innovations in the Russian knowledge-intensive business services sector is comparable with the relevant figures for a number of European countries. However, the share of companies applying organisational innovations in this sector in Russia is much lower than in Europe. When asked to identify the main barriers hindering the sector’s development, non-innovative companies most often mentioned client-related issues (low demand, insufficient awareness of available services, lack of competences required to use services), and lack of skilled personnel.

The newsletter is based on data collected through monitoring of the knowledge-intensive business services sector by the HSE ISSEK, and on the results of the project “Development of theoretical and methodological approaches to studying activities of innovation process participants” of the HSE Basic Research Programme.

By Nikolay Chichkanov and Veronika Belousova

1 Doroshenko M., Miles I., Vinogradov D. (2014) Knowledge Intensive Business Services: The Russian Experience // Foresight-Russia, Vol. 8, Iss. 4, pp. 24-38.

2 The European Economic Community’s Statistical Classification of Economic Activities (NACE Rev. 2) traditionally includes the following activity types into the knowledge-intensive business services sector: J62 (development of computer software, relevant consulting services, other related services), J63 (activities of information agencies), M69 (legal and accounting services), M70 (activities of companies’ head offices, management consulting), M71 (architectural, engineering and technological design services, technical testing, research and analysis), M72 (research and development), M73 (advertising, market research)9. Also, a significant share of highly skilled workers of financial organisations’ staff allows to include these companies (defined as K64 (financial services, except insurance and pension funds)) into the knowledge-intensive business services sector too.

3 Miles I. (2005) Knowledge-intensive business services: prospects and policies // Foresight, Vol. 7, Iss. 6, pp. 39-63.

4 Muller E., Doloreux D. (2009) What we should know about knowledge-intensive business services// Technology in Society, Vol. 31, pp. 64–72.

5 Berezin I.S., Doroshenko M.E. (2015) Quantitative and qualitative changes in the Russian knowledge-intensive business services sector market in 2005-2013. // Marketing in Russia. 2015 / Scientific editor I.S. Berezin. М., pp. 85-128 (in Russian)

6 Data for the European countries were collected in the course of the Community Innovation Survey (CIS-2014).

7 Data for Russia was collected by the HSE ISSEK in 2015 through a survey of 526 companies (except the R&D sector) in the scope of the monitoring study of the knowledge-intensive business services sector, conducted in the following cities: Moscow, St. Petersburg, Tyumen, Krasnodar, Yekaterinburg, Kazan, Ufa, Krasnoyarsk, Samara, Nizhny Novgorod, Rostov-on-Don, Perm, Chelyabinsk, Novosibirsk.

8 Amara N., D’Este P., Landry R., Doloreux D. (2016) Impacts of obstacles on innovation patterns in KIBS firms // Journal of Business Research, Vol. 69, Iss.10, pp. 4056-4073.

9 Schnabl E., Zenker A. (2013) Statistical Classification of Knowledge-Intensive Business Services (KIBS) with NACE Rev. 2 // evoREG Research Note no 25, Fraunhofer Institute for Systems and Innovation Research, Karlsruhe, 11 p.